Introduction to PCB manufacturing

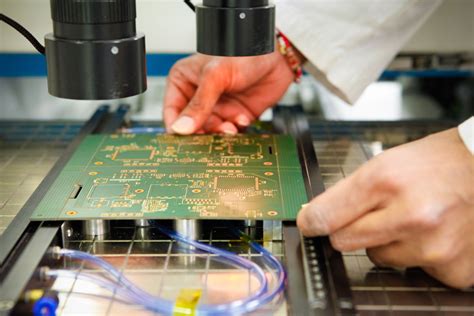

Printed Circuit Boards (PCBs) are the backbone of modern electronics. They are used in almost every electronic device, from smartphones and computers to medical equipment and aerospace technology. PCB manufacturing is a complex process that involves multiple steps, including design, fabrication, assembly, and testing. In this article, we will explore the current state of PCB manufacturing in the United States and answer the question: Are PCBs still manufactured in the US?

What are PCBs?

PCBs are thin, flat boards made of insulating materials, such as fiberglass or plastic, with conductive pathways etched or printed on the surface. These pathways, known as traces, connect various electronic components, such as resistors, capacitors, and integrated circuits (ICs), to form a complete circuit. PCBs come in different types, including:

- Single-sided PCBs: These have conductive traces on one side of the board only.

- Double-sided PCBs: These have conductive traces on both sides of the board, connected by plated through-holes.

- Multi-layer PCBs: These have multiple layers of conductive traces, separated by insulating layers, allowing for more complex circuits and higher component density.

The Importance of PCBs in Modern Electronics

PCBs have revolutionized the electronics industry by enabling the miniaturization and standardization of electronic devices. They offer several advantages over traditional point-to-point wiring, including:

- Increased reliability: PCBs provide a stable and durable platform for electronic components, reducing the risk of loose connections and short circuits.

- Improved performance: The precise layout of traces on a PCB minimizes signal interference and ensures optimal signal integrity, resulting in better overall performance.

- Reduced size and weight: PCBs allow for compact and lightweight designs, making electronic devices more portable and efficient.

- Lower manufacturing costs: The standardized and automated nature of PCB manufacturing processes results in lower production costs, especially for high-volume production.

The History of PCB Manufacturing in the US

The United States has a long history of PCB manufacturing, dating back to the 1950s. In the early days, PCBs were primarily used in military and aerospace applications, where reliability and performance were critical. As the technology advanced and became more affordable, PCBs found their way into consumer electronics, such as radios, televisions, and computers.

The Rise of the US PCB Industry

During the 1960s and 1970s, the US PCB industry experienced significant growth, driven by the increasing demand for electronic products. Many US companies, such as IBM, Hewlett-Packard, and Intel, invested heavily in PCB manufacturing facilities to support their own product lines. Additionally, a thriving ecosystem of independent PCB manufacturers emerged to serve the needs of smaller companies and startups.

The Shift to Offshore Manufacturing

In the 1980s and 1990s, the global electronics industry began to shift towards offshore manufacturing, particularly in Asia. Countries like China, Taiwan, and South Korea offered lower labor costs, favorable government policies, and a rapidly growing supply chain, making them attractive destinations for PCB manufacturing.

As a result, many US companies started outsourcing their PCB production to these countries, either by setting up their own facilities or by partnering with local manufacturers. This trend accelerated in the 2000s, as the demand for consumer electronics skyrocketed and price competition intensified.

The Current State of PCB Manufacturing in the US

Despite the shift towards offshore manufacturing, PCB production in the United States has not disappeared entirely. In fact, the US still has a significant presence in certain segments of the PCB market, particularly in high-end, specialized applications.

US PCB Market Share

According to a report by the IPC (Association Connecting Electronics Industries), the United States accounted for approximately 4.3% of the global PCB market in 2019, with a production value of $3.8 billion. While this may seem small compared to China’s 50.3% market share, it still represents a substantial portion of the global market, particularly in terms of value-added production.

| Country | Market Share (%) | Production Value ($ Billion) |

|---|---|---|

| China | 50.3 | 31.8 |

| Japan | 9.7 | 6.1 |

| Taiwan | 9.6 | 6.1 |

| South Korea | 6.8 | 4.3 |

| United States | 4.3 | 3.8 |

| Rest of the World | 19.3 | 12.2 |

Strengths of the US PCB Industry

The US PCB industry has several key strengths that allow it to remain competitive in the global market:

-

Focus on high-end, specialized applications: US PCB manufacturers often specialize in producing boards for industries with stringent performance and reliability requirements, such as aerospace, defense, medical, and telecommunications.

-

Advanced technology and expertise: US companies are at the forefront of PCB technology, with expertise in advanced materials, high-density interconnects (HDI), and complex multi-layer designs.

-

Proximity to customers: For US-based electronics companies, working with local PCB manufacturers offers advantages in terms of communication, collaboration, and shorter lead times.

-

Intellectual property protection: The strong intellectual property laws in the United States provide a safer environment for companies to develop and manufacture proprietary technologies.

Challenges Facing the US PCB Industry

Despite its strengths, the US PCB industry also faces several challenges:

-

Cost competition: Offshore manufacturers, particularly in Asia, often have lower labor and production costs, making it difficult for US companies to compete on price alone.

-

Supply chain complexity: Many of the raw materials and components used in PCB manufacturing are sourced from overseas, which can lead to longer lead times and potential supply chain disruptions.

-

Skill shortage: As the PCB industry evolves, there is a growing need for skilled workers with expertise in advanced manufacturing techniques and technologies. Attracting and retaining talent can be a challenge for US companies.

-

Environmental regulations: Strict environmental regulations in the United States can increase the cost and complexity of PCB manufacturing, compared to countries with more lenient regulations.

The Future of PCB Manufacturing in the US

Despite the challenges, there are several reasons to be optimistic about the future of PCB manufacturing in the United States.

Reshoring and Nearshoring Trends

In recent years, there has been a growing trend towards reshoring and nearshoring, as companies seek to reduce their reliance on offshore manufacturing and improve supply chain resilience. The COVID-19 pandemic has accelerated this trend, highlighting the risks of over-dependence on a single region for critical components.

As a result, some US electronics companies are considering bringing PCB manufacturing back to the United States or to nearby countries, such as Mexico or Canada. This shift could create new opportunities for US PCB manufacturers and help revitalize the industry.

Government Support and Initiatives

The US government has recognized the strategic importance of the PCB industry and has taken steps to support its growth and competitiveness. For example:

- The Department of Defense has initiatives to strengthen the domestic PCB supply chain, such as the Trusted Foundry Program and the Defense Electronics Consortium.

- The CHIPS for America Act, introduced in 2020, aims to provide incentives for semiconductor and advanced packaging manufacturing in the United States, which could indirectly benefit the PCB industry.

- The Biden administration has emphasized the need to invest in domestic manufacturing and secure critical supply chains, which could lead to additional support for the PCB industry.

Technological Advancements

The US PCB industry is well-positioned to capitalize on emerging technologies and trends in the electronics industry, such as:

- 5G and high-speed communications: The rollout of 5G networks and the growing demand for high-speed connectivity will require advanced PCBs with high-frequency capabilities and low signal loss.

- Internet of Things (IoT): The proliferation of connected devices will drive demand for compact, low-power PCBs that can be integrated into a wide range of products.

- Artificial Intelligence (AI) and edge computing: As AI and machine learning applications move closer to the edge, there will be a need for specialized PCBs that can handle high-performance computing and data processing.

- Advanced packaging technologies: Innovations in PCB packaging, such as 3D printing, embedded components, and flexible substrates, will enable new design possibilities and applications.

By staying at the forefront of these technologies, US PCB manufacturers can maintain their competitive edge and capture new growth opportunities.

Conclusion

In conclusion, while the US PCB industry has faced challenges and competition from offshore manufacturers, it remains a significant and vital part of the global electronics supply chain. US companies have strengths in high-end, specialized applications and advanced technologies, and there are reasons to be optimistic about the future of PCB manufacturing in the United States.

As reshoring and nearshoring trends gain momentum, and with support from the government and ongoing technological advancements, the US PCB industry has the potential to not only survive but thrive in the coming years. By focusing on innovation, skill development, and supply chain resilience, US PCB manufacturers can continue to play a critical role in enabling the next generation of electronic devices and technologies.

Frequently Asked Questions (FAQ)

-

Q: What is the market share of the US PCB industry compared to other countries?

A: As of 2019, the United States accounted for approximately 4.3% of the global PCB market, with a production value of $3.8 billion. China, by comparison, held a 50.3% market share. -

Q: What are some of the key strengths of the US PCB industry?

A: The US PCB industry has strengths in high-end, specialized applications, advanced technology and expertise, proximity to customers, and strong intellectual property protection. -

Q: What challenges does the US PCB industry face?

A: The US PCB industry faces challenges such as cost competition from offshore manufacturers, supply chain complexity, skill shortages, and strict environmental regulations. -

Q: What trends could potentially benefit the US PCB industry in the future?

A: Reshoring and nearshoring trends, government support and initiatives, and technological advancements in areas such as 5G, IoT, AI, and advanced packaging technologies could create new opportunities for the US PCB industry. -

Q: What steps can US PCB manufacturers take to remain competitive in the global market?

A: US PCB manufacturers can remain competitive by focusing on innovation, skill development, and supply chain resilience, while capitalizing on emerging technologies and trends in the electronics industry.

No responses yet